If you are reading this in January 2026, you likely have one major financial resolution on your mind: conquering your student debt.

In 2026, interest rates, inflation, and cost-of-living pressures have made it even more important to manage student loans intelligently.

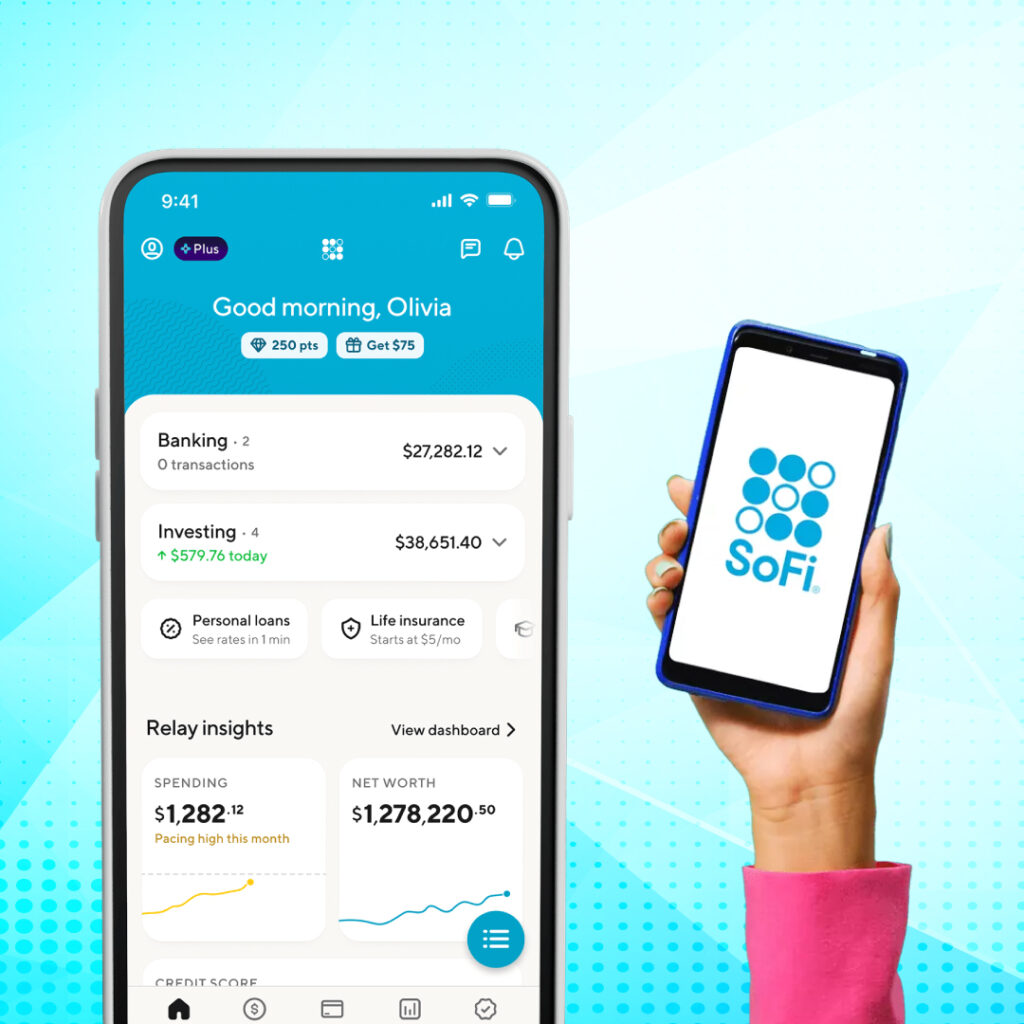

One of the smartest money moves many borrowers are making right now is student loan refinancing and SoFi Student Loan Refinance remains one of the most trusted and competitive options in the market.

This guide explains how SoFi student loan refinancing works, who it’s best for, and how it can potentially save you thousands over the life of your loan.

Update: SoFi just dropped rates

Checking rates won’t affect your credit

Why Borrowers Are Refinancing with SoFi

Refinancing isn’t just about chasing a lower rate. It’s about control.

SoFi offers:

- No origination, prepayment, or late fees

- Competitive fixed and variable interest rates

- Flexible repayment terms to fit your budget

- Autopay discounts to reduce your rate further

More than 550,000 members have already refinanced over $47 billion in student loans.

Checking rates won’t affect your creditHow Student Loan Refinancing Works

Refinancing replaces one or more existing student loans with a new loan, ideally at a lower interest rate.

You may be able to:

- Lower your monthly payment

- Reduce total interest paid

- Pay off your loan faster

- Combine multiple loans into one simple payment

Use the SoFi Student Loan Refinance Calculator to see potential savings before applying.

Checking rates won’t affect your creditFixed vs Variable Rates: Choose What Fits Your Plan

Fixed Rates

- Consistent monthly payments

- Protection from future rate increases

- Ideal for long-term stability

Variable Rates

- Typically start lower

- May change with market conditions

- Best for faster payoff strategies

SoFi lets you compare both options side by side.

Simplify Your Finances with One Monthly Payment

If you’re managing multiple loans with different servicers and due dates, refinancing can consolidate everything into one predictable monthly payment.

That means:

- Less stress

- Fewer missed payments

- Better financial clarity

Who Should Consider Refinancing?

You may be a good candidate if you:

- Have good to excellent credit

- Have steady income or employment

- Want to reduce interest costs

- Prefer predictable payments

Refinancing federal loans into a private loan removes access to federal protections such as income-driven repayment and forgiveness programs. Always evaluate your situation carefully.Free Up Cash for What Matters Next

Lower monthly payments can help you redirect money toward:

- Buying a home

- Investing for retirement

- Building an emergency fund

- Growing your career or business

Refinancing isn’t just debt management, it’s financial momentum.

Get Started in Minutes

Checking your rate is fast and simple:

- View your personalized rate options

- Choose a term that fits your goals

- Submit your application online

No hidden fees. No pressure. Just clarity.